The NIF (Número de Identificação Fiscal) is the very first administrative step you need to take when moving to Portugal. It’s also known as the “número de contribuinte.” This 9-digit code represents your official ID for administrative matters in the country—essentially, you’ll need it everywhere you go.

Below, I’ll explain how to obtain a NIF for free (whether you’re in Portugal or abroad), what the timeframe is, the costs, and your obligations.

What is the Portuguese NIF for, and how do you get one?

The NIF is a unique taxpayer identification number assigned to every individual or business in Portugal—whether you’re a resident or not. It’s used to identify taxpayers for all of their financial transactions across Portuguese territory.

When is a Portuguese NIF mandatory?

All over Portugal, you’ll notice that—before anyone even asks for your name—they’ll ask for your NIF first. This applies to practically all financial transactions.

While you’ll be asked for your NIF frequently, it’s not always compulsory to provide it. However, there are specific instances where giving your NIF is mandatory:

- Opening a bank account

- Buying or renting real estate

- Getting a phone line

- School enrollments

- Major purchases, such as property or a car

- Requesting a residency certificate

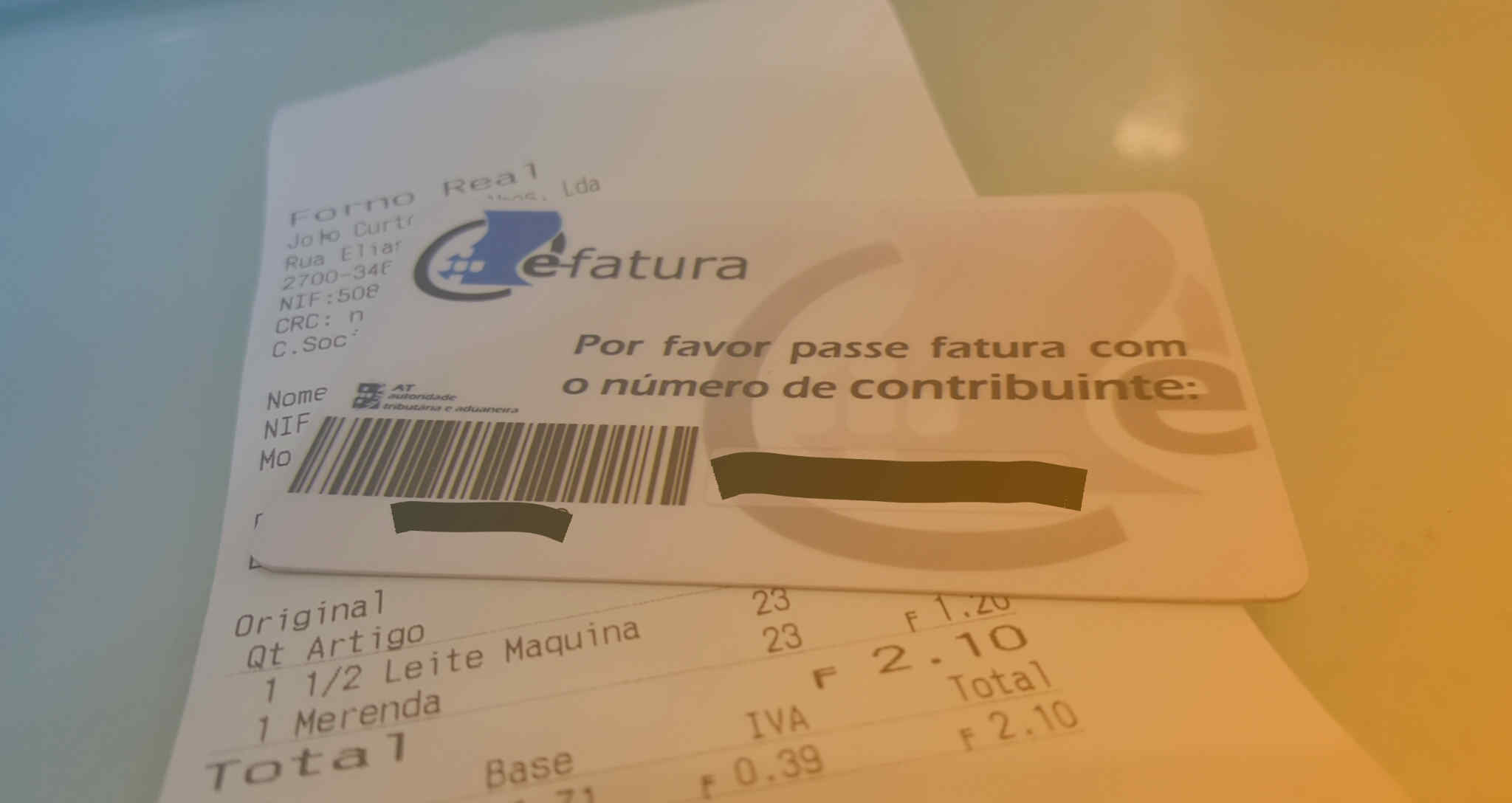

Tip: When you’re at the checkout counter (for groceries or other items), you may also be asked for your NIF so you can benefit from tax deductions (i.e., pay lower taxes).

Who can apply for a NIF?

According to Decree No. 14/2013 of January 28, anyone—resident or not—who needs to fulfill tax obligations in Portugal can (and must) have a número de contribuinte (NIF). There is no distinction regarding age or nationality.

Where can you find the NIF in Portugal? A concrete example

If you’re Portuguese, your NIF number appears on the back of your ID card (the first series of 9 digits). You’ll need it for all transactions in Portugal as well as for dealings with the tax administration.

For example, when ordering furniture, the store might ask for your NIF as a form of client identification instead of a customer number. Otherwise, you can also get your NIF by asking at a “das finanças” center or at a “Loja do Cidadão.”

How do you get a Portuguese NIF online for free?

You can obtain a NIF online—completely free of charge—via the Portuguese government website (e-Balcão).

- If you’re abroad (or in another country), you’ll need a fiscal representative in Portugal (often called a fiscal agent or “mandatário fiscal”). Think of them as a sponsor who can carry out the online application on your behalf, using their own login credentials.

- If you’re in Portugal, you can visit a local tax office (das finanças) to apply in person, or use the government’s e-Balcão service if you have all the required documentation.

Timeframe and methods to get your NIF in 2025

In 2024, there are three main ways to obtain your NIF:

- Online, via the government service (e-Balcão).

- Remotely, through a specialized agency (this is often a paid service).

- In-person, in Portugal (by going to a “das finanças” office or a “Loja do Cidadão”).